US Securities Lending Technical Architecture Comparative Analysis

- Ross Levin

- Feb 21, 2016

- 3 min read

In this article we will attempt to make a comparison between different architectural models supporting US Securities Lending business.

In the current business landscape, where the cost is becoming the number one priority for a business, it is important to understand the pros, the cons, and the tradeoffs of different technology offerings.

Throughout this analysis, all other parts of Securities Finance, including repo, non-US securities lending, and any synthetic financing components, are excluded, although some scenarios are more favorable to different product types.

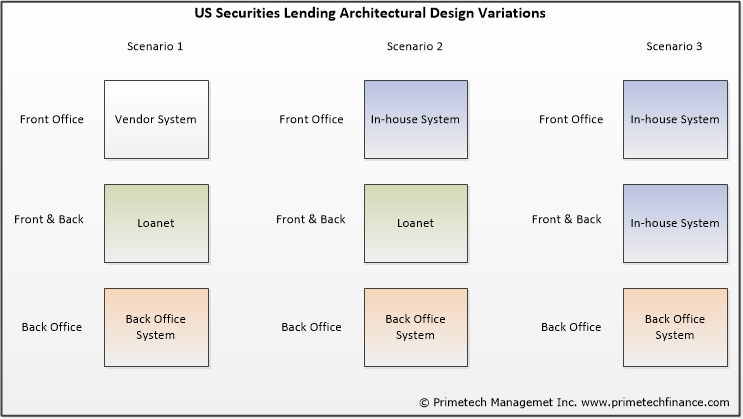

Overall, there are three types of architectural designs used by the entire industry:

Loanet in the middle, vendor system on top

Loanet in the middle, in-house system on top

In-house system in the middle, in-house system on top

When you look at the three scenarios above, you need to overlay them with these four attributes to ensure efficiency:

Scalability

Maintainability

Support Cost

Customization

The table above displays a simplified view of these attributes for each outlined scenario. It is easy to pick one scenario that fits your needs by weighing each attribute based on its importance to your organization, and come up with a weighted average score.

For instance, let’s assume that Scalability and Customization Level are the least important factors followed by Maintainability, followed by Support Cost, which is the most important factor. In this case, the first scenario is the most fitting, followed by the second, followed by the third.

If all quality attributes are equally important for you, then the first and the second scenarios have almost equal weighting and are best fit for your needs.

Let’s take the quantitative approach out of this and take a human look at each component.

Loanet

Variable, volume based monthly cost

Unlimited scalability at no additional charge

Very low maintenance cost, requires no support staff

Cost becomes a concern with either tiny or very large books and run rate to revenue ratio has to be taken into consideration

Comes shrink-wrapped with no customizations available or offered

Built-in market data

Built-in downstream feeds to industry’s most commonly used back office systems, i.e. Broadridge BPS

Vendor Front End

Requires several vendors based systems in order to incorporate most of your needs

Cost varies vendor by vendor

Some vendors do not offer cloud based installation increasing the infrastructure cost and scalability concerns

Maintenance requirements differ between vendors and some of them would require dedicated support staff

All vendors offer customizations but at a cost

Integration could be as simple as connecting the system to Loanet MQ or as complex as putting together special security protocols and various integration bridges

In-house Front End

Requires specialized expertise and SMEs to integrate with Loanet

Scalability requires infrastructure investment

Maintenance may become an issue increasing operational risk concerns

Heavy initial architectural design investment may be required in order to lower support cost

High customization levels

All in-house

Significant investment and time to market if launching a new business

Scalability and maintainability require a precise business architecture and very specific business and technology knowledge

Connectivity to DTCC and encompassing all possible transaction details is not a trivial task

More implications for regulatory reporting and general ledger/back office updates

Requires a market data subscription to get a full MSD (master security database), pricing, corporate actions and other relevant data

Other factors that need to be taken into consideration are

Risk Components

Settlement Risk

Operational Risk

Market Risk (securities pricing)

Regulatory Compliance

Reserve Calculations (Rule 15C3-3)

Non-traditional collateral implications (non-cash, cash pool, etc.)

Financial Components

Balance Sheet considerations

Return on Investment (ROI)

Risk Adjusted Return on Capital (RAROC)

Technology organization maturity level

In conclusion, in our opinion, unless your organization’s maturity level is very high and the number of daily outstanding open contracts is above the 25,000 level, it is very difficult to not include Loanet in your architectural design.

Loanet is the only securities lending service that provides all the components for a successful business launch and smooth run right out of the box. You can definitely try to connect directly to DTCC and let your own in-house system take care of all the details but the amount of these details is overwhelming and each of them would need to be carefully risk-weighted.

Ready to assess your particular situation? Need a full cost analysis or a business plan? How about a full project plan with all issues and risks? Contact us for a confidential assessment.

© 2016 Primetech Management Inc. The names of other companies, products and services are the property of their respective owners.

Comments