Don't Be Afraid of The Outsourcing

- Ross Levin

- Mar 22, 2016

- 4 min read

Outsourcing… The term usually triggers a negative reaction from everyone, whether it’s Business Process Outsourcing (BPO) or Information Technology Outsourcing (ITO).

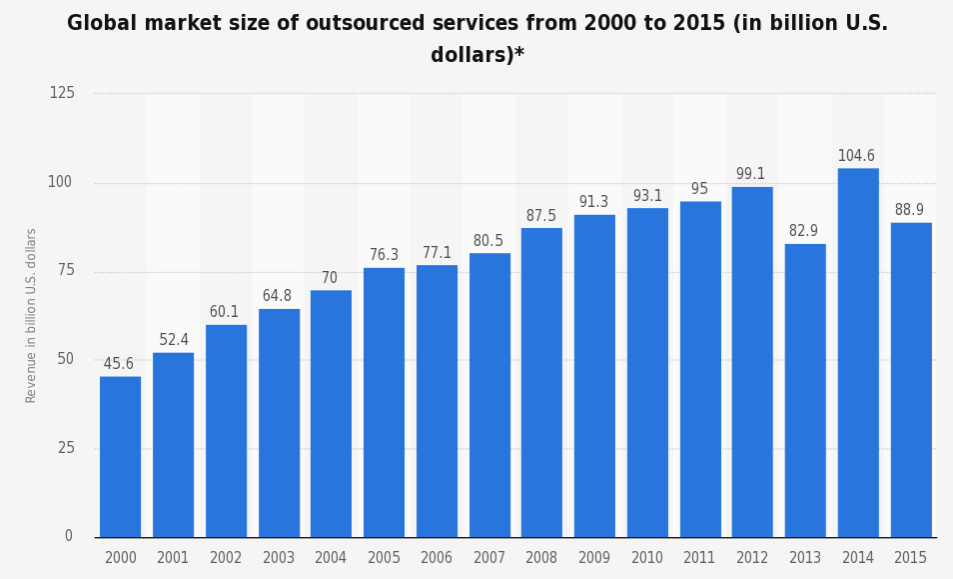

Even though the revenue of all outsourcing contracts hit an all-time high in 2014, if you look at the history of large outsourcing deals, they usually end up being insourced. This is especially true for the Financial Services industry.

Source: Information Services Group

Why such a trend? There are several main factors:

Complex contract structure

Complex outsourced products

Increased time to market for new projects

Lack of transparency

Frictions between outsourced and in-house teams

Indeed, if you are trying to outsource on the enterprise level, it is not a simple exercise. You need to manage multiple Requests for Proposals (RfPs), establish proper Service Level Agreements (SLAs), and manage them through a robust Change Management process.

But what if you are trying to do this on the departmental level, or for the business product lines that have commoditized, to the point where achieving either more automation on the technology side or operational efficiency on the business side either doesn’t make sense or is simply too costly to implement?

In our view, Securities Finance business is one of these areas. From the processing perspective, the industry hasn’t really changed in years. Technology innovations usually come into play only with the new regulatory changes, and operational support follows the same old trading life cycle model.

Looking strictly at ITO, in order to conduct the business in a fully outsourced fashion, you need these core modules to handle securities lending or repo transactions:

Trade Input

Positions Management

Inventory Management

You may require more depending on your organizational needs. Prime Brokers would need the allocation module, agent lenders would need the allocation and cash pooling/reinvestment module, and independent broker dealers might require a more sophisticated availability routine. But all of them can still transact with just the three functional modules listed above.

If this is the case, why do you need a technology organization at all? In our opinion, you don’t. All of the three core modules can easily be obtained through various vendors, many of which will offer much more, most likely covering the most sophisticated add-on logic you may require.

Why then some companies have 100’s of people in IT organizations supporting Securities Finance business? This happens when technology organization drives business changes. Technology may employ many business analysts who will come up with great [E3] interfaces, thinking that this is what the trader (operations person/risk manager/etc.) needs but, when presented to end users, they usually go back to the drawing board. It will finally get done, but the time spent on these simple tasks can never be recovered.

How do we change this?

First and foremost, the business should drive the change and be in a position to look at the internal solution as a part of a holistic approach that includes the industry vendors and independent reviews to help the business validate which approach is the most fitting. For larger projects, this may include formal Requests for Proposal (RFPs), with proposals coming from vendors and internal technology organizations.

Secondly, there should be a clear delineation between core processing and business-specific functionality. This would help establish a business architecture that will be based on agility and modularization, which, in turn, will make any project’s implementation an easy exercise.

And finally, there needs to be a mindset change. This is by far the most difficult task, as you can’t really quantify it. If you have been thinking lately why certain tasks or projects are taking such a long time to implement, or why there are so many repetitive issues, your mind is on the right track.

The only issue we see making a vendor deployment process difficult is that there is no one single vendor in the Securities Finance industry who offers a universal solution.

The only issue we see making a vendor deployment process [E1] difficult is that there is no one single vendor in the Securities Finance industry who offers a universal solution:

There is no one single vendor that can offer full autoborrowing and autolending capabilities and sophisticated positions management at the same time.

There are only a few vendors combining U.S. domestic and foreign capabilities.

There are none offering more advanced repo-style capabilities, such as offering evergreen and bullet-tenored transactions.

Surprisingly, there are no vendors that offer a robust P&L module, something that goes beyond a simple rebate calculation.

Most importantly, there are none that offer a full customization mechanism where one can tag or change any field or create a new field and trigger a different chain of events or calculations as a result.

I don’t think there are any in-house systems out there with the same capabilities though.

So, what’s the verdict?

Change your mindset and open it for a new vision

Make a business architecture assessment

Implement one of the many core functionalities on the Proof of Concept basis

Evaluate the efficiency and deploy next set of modules

Ready to assess your particular situation? Need a full cost analysis or a business plan? How about a full project plan with all issues and risks? Contact us for a confidential assessment.

Comments